What is marriage allowance?

Tying the knot is a momentous occasion, but when the dust settles after the wedding vows, there are various financial implications for married couples to consider, from your tax status to your property rights. Here, we’ll look at one of the ways married couples can protect themselves financially by exploring what the marriage tax allowance means and how you might apply.

You might also be interested in...

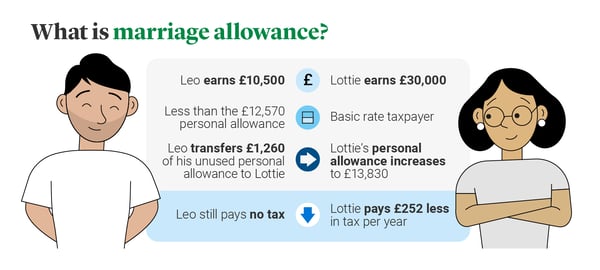

Marriage allowance is a tax incentive that some married couples and civil partners are entitled to. This UK government scheme was first introduced in 2015. could help your partner reduce their tax bill by £252 a year if they earn more than you.

If you have a husband, wife or civil partner, the marriage allowance may let you to transfer up to £1,260 of your Personal Allowance to your spouse or partner. However, there is more to marriage allowance eligibility than meets the eye, as we’ll explain next.

If you’re unsure whether you can apply for marriage allowance, below is a summary of the eligibility criteria.

- You’ll need to be married or in a civil partnership. Co-habiting or 'common law' couples who aren’t married or in a civil partnership are not eligible for marriage allowance.

- The partner who earns the least must earn less than the personal allowance (£12,570 for 2023/24).

- The higher earning partner must be a basic rate taxpayer, meaning they earn between £12,571 to £50,270.

How does marriage allowance work?

Once you’ve determined that you have a right to claim marriage allowance, what does the process involve? Here is a step-by-step summary:

Step 1

If you’re the lower earning partner, you can first apply to HMRC and ask to transfer any unused personal allowance to your partner.

Step 2

Once approved, your partner will receive a tax credit that matches the personal allowance they’ve received from you.

Step 3

The tax is deducted from your partner’s tax bill.

Finally, your tax code will change once you’ve successfully applied for marriage allowance and your code will end with M after your marriage allowance eligibility is confirmed.

In order to apply for marriage allowance, you will need both yours and your partner’s National Insurance number. You can then apply online through your Government Gateway account. Read more about the online application process on GOV.CO.UK.

You can also apply through your Self Assessment or by writing to HMRC if you are unable to apply online.

Yes, you can make a backdated marriage allowance claim to cover any tax year since 5th April 2018 where you were entitled to marriage allowance.

Yes, you can still claim marriage allowance if you’re both retired. As with other stages of life, the person transferring the allowance must have a taxable income below their personal allowance, and the person receiving the allowance must be a basic rate taxpayer.

You can online by providing the information you normally supply to HMRC about your identity. You only need to cancel your marriage allowance if your relationship ends following a divorce, legal separation or your civil partnership has dissolved.

Either you or your partner can cancel the marriage allowance if the relationship has ended, but if you’re cancelling for any other reason, the person who originally made the claim will need to cancel. The marriage allowance will transfer to your partner each year unless you request to cancel it.

How life insurance can give couples financial protection

If you have dependants, such as a partner or children, life insurance could provide financial protection when they need it most. If you were to pass away, the payout from a life insurance policy could help your loved ones pay the mortgage or rent or household bills and everyday living costs.

You and your partner could opt for single or joint life insurance. A joint life insurance policy would pay out once when the first person were to die and then the policy would end. Two single policies could pay out on the death of each person covered, providing the claims are valid.